1. Choosing a Reliable CopyTrading Platform

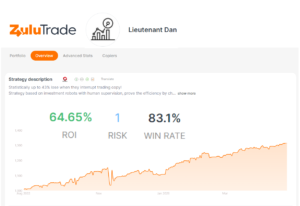

Selecting the right platform is fundamental for successful copy trading. Platforms like Tickmill, FortunaMax TCM, FP Markets Lieutenant Dan, FortunaDozer (PAMM Account), and Collective2 are among the noteworthy choices. These platforms differ in their offerings and the traders available for replication.

2. Exploring Effective Strategies: FortunaMax Zion

One standout example is FortunaMax Zion, demonstrating a solid monthly return close to 6%. Its strategic approach, operational since 2016, has consistently attracted investors seeking reliability and consistent results. The key lies in its focus on highly liquid currency pairs like EUR/USD and GBP/USD, leveraging proprietary algorithms to identify prime entry and exit points.

3. Analyzing Traders for Replication

After signing up, the next step involves scrutinizing available traders. Analyzing their performance, understanding their trading history, return on investment, and associated risks are pivotal factors. For instance, traders like Tickmill FortunaMax Zion, FP Markets Lieutenant Dan, and FortunaDozer showcase positive performance worth considering.

4. Simulating CopyTrader Scenarios

Let’s simulate a practical scenario in the EUR/USD market. Imagine yourself replicating the operations of a successful trader. Following their trade in the currency pair EUR/USD, one can witness the process in action.

5. A Practical Trade Scenario

Consider an experienced trader’s action of buying 1000 euros at $1.2 each (EUR/USD) and selling at $1.23 the next day. CopyTrader mirrors this action, yielding a $30 profit. Understandably, a commission is usually paid to the trader, typically ranging from 10% to 40%.

6. Cautionary Considerations and Beginner’s Strategies

While CopyTrader offers potential, it’s imperative to acknowledge the associated risks. Past performance doesn’t guarantee future results, and the market is subject to fluctuations. Novices are advised to start cautiously, familiarizing themselves with the platform and starting with smaller amounts before escalating their investments.

7. Testing Strategies for Beginners

For those starting with minimal investment, testing strategies like Robot Scalper Zion Free and Billionaire Boys Club, with returns and associated risks, can provide insights without substantial financial commitment.

Conclusion

CopyTrader presents a promising gateway for aspiring investors, allowing replication of successful trades with ease. However, it’s critical to comprehend the risks, conduct thorough research, and exercise caution.

FAQs

- Is CopyTrader a guaranteed way to profit?

- CopyTrader doesn’t guarantee profits. It replicates successful trades but is subject to market risks.

- What kind of traders should one consider for replication?

- Traders with a consistent track record and manageable risks are preferable.

- Does CopyTrader work well for beginners?

- Yes, but starting with caution and small amounts is advisable.

- Are there fixed commission rates for copied trades?

- The commission rates vary, often ranging from 10% to 40%.

- Should I solely rely on copied trades for investment decisions?

- It’s recommended to diversify and not rely solely on copied trades.