Outline Table

| Heading | Subheading |

|---|---|

| Introduction | What is Copy Trading? |

| Tickmill Overview | Basics of Tickmill |

| Copy Trading Mechanism | Understanding the Process |

| How CopyTrade Works | Functionality Explained |

| Benefits of Copy Trading | Advantages and Opportunities |

| Risks and Caution | Understanding the Pitfalls |

| Choosing a Strategy | Factors to Consider |

| Tips for Success | Making Copy Trading Work |

| Monitoring Your Investments | Ensuring Success |

| Copy Trading in Tickmill | Specifics of the Platform |

| Conclusion | Recap and Insights |

| FAQs | Common Queries |

Introduction

The financial realm has witnessed a revolutionary approach to trading, known as “Copy Trading.” This innovative method, like that offered by Tickmill, has transformed how individuals engage in financial markets. But what is copy trading, and how does it function within platforms like Tickmill?

Tickmill Overview

Before diving into the mechanics of copy trading, understanding the basics of Tickmill is essential. Tickmill is a leading financial platform that provides access to a wide array of trading instruments.

What is Copy Trading?

At its core, copy trading is a system that allows individuals to replicate the trades executed by experienced and successful investors. It operates on a simple premise: copying the trading strategies of seasoned professionals.

Copy Trading Mechanism

To comprehend how copy trading functions, it’s crucial to understand the process behind it. The mechanism involves a transparent replication of trading actions performed by skilled investors.

How CopyTrade Works

Platforms like Tickmill facilitate this process by allowing users to connect with expert traders and copy their strategies in real-time.

Benefits of Copy Trading

The advantages of copy trading are vast, offering opportunities for both novices and experienced traders. It provides a gateway for newcomers to enter the financial markets with confidence.

Risks and Caution

However, it’s crucial to note the associated risks. Copy trading isn’t devoid of pitfalls, and understanding these risks is vital for anyone considering this method.

Choosing a Strategy

Selecting the right strategy for copy trading involves considering various factors. Factors such as risk tolerance, investment goals, and preferred markets play a pivotal role.

Tips for Success

For those venturing into copy trading, a set of tips can enhance the chances of success. These strategies can make the experience more fruitful and rewarding.

Monitoring Your Investments

A key element of successful copy trading is regularly monitoring your investments. It’s essential to maintain an active involvement in tracking your copied trades.

Copy Trading in Tickmill

Tickmill offers a comprehensive platform for copy trading, providing specific tools and functionalities that cater to both novices and seasoned traders.

Conclusion

In conclusion, copy trading within platforms like Tickmill offers a doorway to the financial markets. It’s an innovative approach that merges the expertise of professionals with the ambitions of aspiring traders.

FAQs

1. Is copy trading suitable for beginners?

Copy trading can be suitable for beginners as it allows them to replicate the strategies of experienced traders, learning from their expertise.

2. What are the risks associated with copy trading?

The risks involve the potential loss of capital, as trading always carries inherent risks. Copy trading doesn’t guarantee profits.

3. How do I select a suitable strategy for copy trading?

Choosing a strategy involves considering factors like risk tolerance, investment goals, and the performance of expert traders.

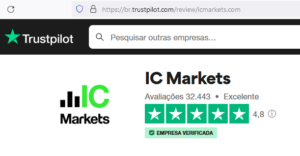

4. Is Tickmill a reliable platform for copy trading?

Yes, Tickmill is a reputable platform offering robust tools and functionalities for copy trading.

5. Can I manually intervene in copied trades?

Yes, users have the flexibility to intervene or close copied trades at their discretion.